utah solar tax credit form

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. This is different from other fully refundable tax credits like the Child Tax Credit and the Health Coverage Tax Credit.

In 2022 the maximum tax credit will be 800.

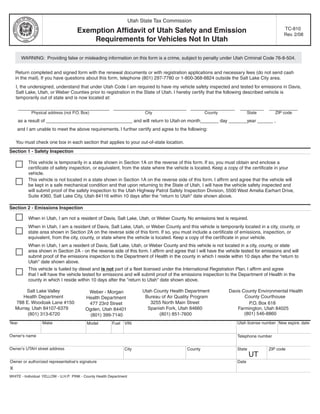

. In utah you can claim up to 1000 in tax credits for switching to solar energy. To claim your solar tax credit in utah you will need to do 2 things. Utah Code 59-10-1106 Get form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp.

For installations completed in 2021 the maximum tax credit will be 1200. High Cost Infrastructure Tax Credit. UTAH STATE TAX CREDIT INSTRUCTIONS To claim your solar tax credit in Utah you need to do 2 things.

2 File for the TC-40e form you request this and then keep the record. However the residential federal solar tax credit cannot be claimed when you put a solar PV system on a rental unit you own though it may be eligible for the business ITC under IRC Section 48. The residential Solar PV tax credit is phasing out and currently installations completed in 2020 the tax credit is calculated as 25 percent of the eligible system cost or 1600 whichever is less for installations on residential dwelling units.

You can claim 25 percent of your total equipment and installation costs up to 800. 261 rows Energy Systems Installation Tax Credit. Only the original purchaser of the new home qualifies for the tax credit.

The Utah residential solar tax credit is also phasing down. Thanks to Utahs solar easement law you can work with your neighbors to make sure that nothing shades your solar panel system while the. As of August 15 2018 solar PV applications require a 15 check to be made out to the Governors Office of Energy Development according to Utah Code 63M-4-401.

Ad The Leading Online Publisher of Utah-specific Legal Documents. Do not send this form with your return. Alternative Energy Development Incentive.

You can make the checks out to. Renewable energy systems tax credit. 1545-0074 Attachment Sequence No.

Write the code and amount of each apportionable nonrefundable credit in Part 3. Attach TC-40A to your Utah return. Local incentives for local people.

If you qualify obtain the latest copy of IRS form 5695 Residential Energy Credits at irsgov and follow the instructions to file for your federal tax credit. Thats in addition to the 26 percent federal tax credit for solar. Below you will find instructions for both.

Note that this tax credit will be reduced in value by 400 each year and expires completely in 2022 Utah is a Right to Solar state. Steps for utilizing the utah solar tax credit. The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects capped at 1600 whichever is less.

To claim your solar tax credit in Utah you will need to do 2 things. Add the amounts and carry the total to TC-40 line 24. Well use 25000 gross cost of a solar energy system as an example.

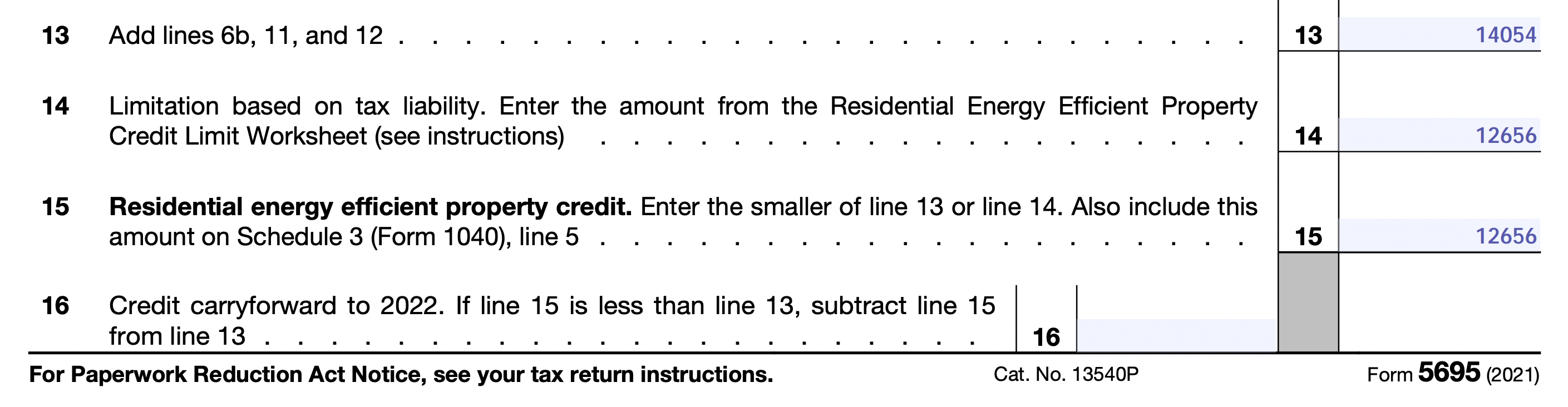

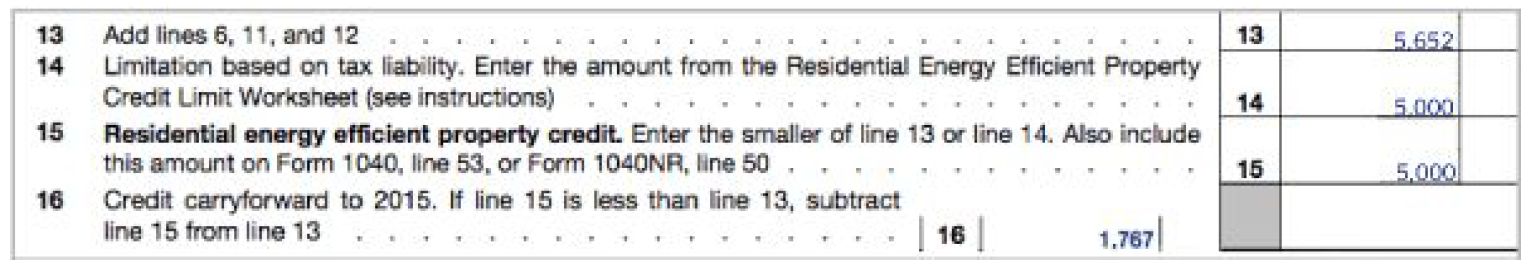

Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells. Below you will find instructions for both. The thing about the solar tax credit is it isnt fully refundable meaning you can only take a credit for what you would have owed in taxes.

158 Names shown on return Your social security number Part I. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs.

This form is provided. To claim this energy credit you must submit a written application to the utah energy office ueo. Solar PV systems do not necessarily have to be installed on your primary residence for you to claim the tax credit.

1 Claim the credit on your TC-40a form submit with your state taxes. Total nonapportionable nonrefundable credits add all Part 4 credits and enter total here and on TC-40 line 26 Submit page ONLY if data entered. Learn more and apply here.

To find out the initial cost of your solar system please contact your community sales representative. Claim the credit on your TC-40a form submit with your state taxes. Do not send form TC-40E with your return.

Attach completed schedule to your Utah Income Tax Return. Enter the following apportionable nonrefundable credits credits that must be apportioned for nonresidents and part-year residents that apply. We are accepting applications for the tax credit programs listed.

Thats in addition to the 26 percent federal tax credit for solar not a bad deal for a system that can. DOWNLOAD INSTRUCTIONS DOWNLOAD FORM FOLLOW THESE INSTRUCTIONS TO GUIDE YOU THROUGH THE TC-40A FORM. Attach to Form 1040 1040-SR or 1040-NR.

Keep the form and all related documents with your records to provide the Tax Commission upon request. USTC ORIGINAL FORM 40104 Income Tax Supplemental Schedule TC-40A Pg. Governors Office of Energy Development PO.

Form 5695 Line 14 Worksheet Reducing the credit Line 14 is where it gets tricky. First you will need to know the qualified solar electric property costs. Get Access to the Largest Online Library of Legal Forms for Any State.

Renewable Energy Systems Tax Credit. Include both the taxpayer name and current address where panels were installed. After seeking professional tax advice and ensuring you are eligible for the credit you can complete and attach irs form 5695 to your federal tax return form 1040 or form 1040nr.

Download your instructions form here. The utah solar tax credit officially known as the renewable energy systems tax credit covers up to 25 of the. 1 SSN Last name 20210000000000000000000000000000000000.

File for the TC-40e form you request this then keep the record. According to the Utah State Tax Commission httpincometaxutahgovcreditsrenewable-energy-systems You can get Form TC-40E Renewable Residential and Commercial Energy Systems Tax Credits from the Governors Office of Energy Development with their certification stamp.

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Instructions For Filling Out Irs Form 5695 Everlight Solar

Costum Real Estate Purchase Agreement Template Sample Purchase Agreement Purchase Contract Contract Template

How To Claim The Solar Panel Tax Credit Itc

![]()

Claiming Your Residential Energy Tax Credit Blue Raven Solar

Instructions For Filling Out Irs Form 5695 Everlight Solar

Pin On Utah Ut Usa Capital Salt Lake City

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

How To Claim The Solar Panel Tax Credit Itc

Tax Utah Gov Forms Current Tc Tc 810

Instructions For Filling Out Irs Form 5695 Everlight Solar

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

How To Claim The Solar Panel Tax Credit Itc

Renewable Energies Concept Collage With Solar Panel Wind Mills And Electrical Energy Infrastucture Sponsor Energia Renovable Potabilizacion Toma De Decisiones

Top Ten Faqs For Federal Solar Tax Credit 2021 Sunpro Solar

The Greatest Network The World Has Ever Seen The Global Internet Map New Scientist Internet Map Map Networking

Instructions For Filling Out Irs Form 5695 Everlight Solar

Electronic Irs Form W 9 2014 Letter Of Employment Irs Forms Certificate Of Participation Template